Commercial Tobacco Prevention and Control

Tobacco Topics

- Behavioral Health

- E-cigarettes and Vapes

- E-cigarette School Toolkit

- Flavored Tobacco

- Menthol Tobacco

- Nicotine

- Quitting Tobacco

- JUUL Settlement

- Helping People Quit

- Secondhand Smoke

- Tobacco and COVID-19

- Tobacco 21

- Tobacco Taxes

- Traditional Tobacco

Related Topics

Contact Info

The Positive Health Impacts of Raising Tobacco Taxes in Minnesota

An MDH-led study, published in 2017, reinforces that increasing tobacco taxes has a powerful impact on the behaviors of people who smoke. The study found that the 2013 cigarette tax increase, which raised the price of cigarettes by $1.60 per pack, led to a substantial number of Minnesotans who smoke attempting to quit or successfully quitting.1 Raising prices will prevent youth from starting to use commercial tobacco products.

Tobacco taxes also have a potentially powerful effect on reducing health care costs. In Minnesota, smoking was responsible for $3.2 billion in excess medical expenditures in 2014. That translates to $593 per person.2

Tobacco taxes keep youth from starting to smoke.

Research shows raising tobacco product prices is one of the most effective tobacco prevention and control strategies.3 Tobacco taxes help raise prices to make cigarettes and other tobacco products too expensive for kids to buy.4

Research shows raising tobacco product prices is one of the most effective tobacco prevention and control strategies.3 Tobacco taxes help raise prices to make cigarettes and other tobacco products too expensive for kids to buy.4

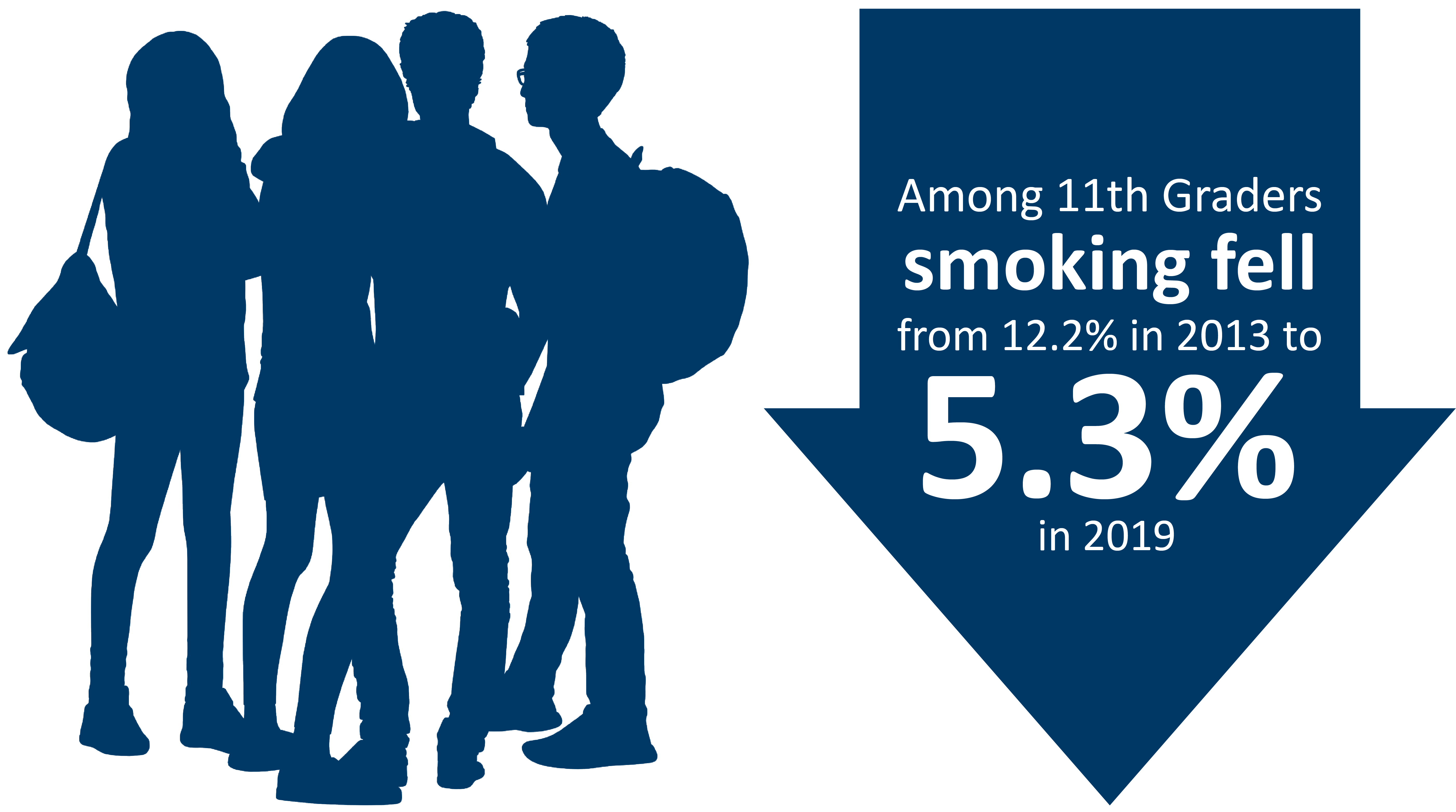

Since the 2013 tobacco tax passed, smoking among Minnesota’s 11th graders has been cut in half.5, 6

Tobacco taxes support Minnesotans in quitting.

Research shows raising tobacco product prices encourages people to quit.7 Since the tobacco tax passed, smoking has decreased by 10% among adults.8

People who smoke reported that the 2013 tobacco tax increase influenced their smoking behaviors, with 60.8% thinking about quitting, 48.1% cutting down on smoking, and 44.2% making quit attempts.9

Among those who successfully quit in the past year, 62.8% reported that the price increase helped them make a quit attempt. 62.7% reported that it helped keep them from smoking again.9

Price increases encourage people to stop smoking but are not enough to help everyone quit. For example, some disparately impacted population groups may need additional tools to be successful.10 Black communities, for instance, have historically been targeted by the tobacco industry, resulting in their higher rates of menthol tobacco use which is easier to start using and harder to quit. Offering additional cessation resources to these groups could improve their success rates – and further increase the effectiveness tobacco taxes.

Long term, raising tobacco product prices could significantly reduce commercial tobacco use. The Minnesota Comprehensive Tobacco Control Framework: 2016-2021 identifies prices increases as a step for reducing youth commercial tobacco use and calls for increased access to cessation resources.

For people who are ready to quit, Quit PartnerTM is here to help.

Quit Partner is Minnesota’s free way to quit nicotine, including smoking, vaping and chewing. Quit Partner offers many support options and resources so that Minnesota residents can find a way to quit that works best for them. Free support includes phone and web coaching, text and email programs, and quit medications like patches, gum or lozenges delivered to your door.

Quit Partner also has specialized programs for people living with mental illnesses or substance use disorders, pregnant and postpartum individuals, American Indian communities (the American Indian Quitline), and youth ages 13–17 (My Life, My QuitTM).

People who use phone coaching and quit medications are more than twice as likely to successfully quit.11

Download this information: The Positive Health Impacts of Raising Tobacco Taxes in Minnesota (PDF)

Learn more

- Behavioral change in response to a statewide tobacco tax increase and differences across socioeconomic status

- Taxation and Product Pricing (Public Health Law Center)

- Tobacco NUMBRS - Tobacco and Nicotine Use in Minnesota: Briefs, Reports, and Statistics

Reference

- Parks, M. J., Kingsbury, J. H., Boyle, R. G., & Choi, K. (2017). Behavioral change in response to a statewide tobacco tax increase and differences across socioeconomic status. Addictive Behaviors, 209-215.

- Blue Cross and Blue Shield of Minnesota. (2017). Health Care Costs and Smoking in Minnesota: the Bottom Line.

- U.S. Department of Health and Human Services. (2014). The Health Consequences of Smoking - 50 Years of Progress. A report of the Surgeon General. Atlanta, GA: U.S. Department of Health and Human Services, Centers for Disease Control and Prevention, National Center for Chronic Disease Prevention and Health PRomotion, Office on Smoking and Health.

- Campaign for Tobacco-Free Kids. (2017, June 1). Raising Tobacco Taxes: A Win-Win-Win. Retrieved from http://www.tobaccofreekids.org/research/factsheets/pdf/0385.pdf

- Minnesota Departments of Health, Public Safety, Education, and Human Services. Minnesota Student Survey Data, 2016.

- Minnesota Departments of Health, Public Safety, Education, and Human Services. Minnesota Student Survey Data, 2019.

- Campaign for Tobacco-Free Kids. (2017, June 1). Raising Tobacco Taxes: A Win-Win-Win. Retrieved from http://www.tobaccofreekids.org/research/factsheets/pdf/0385.pdf

- Centers for Disease Control and Prevention (CDC). Behavioral Risk Factor Surveillance System Survey Data. Atlanta, Georgia: U.S. Department of Health and Human Services, Centers for Disease Control and Prevention, 2013-2015.

- ClearWay Minnesota and Minnesota Department of Health. (2015). Tobacco Use in Minnesota: 2014. Minneapolis.

- Parks, M. J., Kingsbury, J. H., Boyle, R. G., & Choi, K. (2017). Behavioral change in response to a statewide tobacco tax increase and differences across socioeconomic status. Addictive Behaviors, 209-215.

- U.S. Department of Health and Human Services (2020). What You Need to Know About Quitting Smoking: Advice from the Surgeon General.